Tanked

Not content with nearly tanking the economy with their mini-budget, the Truss government has another little problem with tanks, or rather the lack of them. I’m talking about gas tanks.

Back to the 1970s?

Half a century ago, when Tory Edward Heath was Prime Minister, the country was in turmoil with strikes and protests. One such strike was by the coal miners, at a time when (UK-mined) coal was by far the largest source of energy for electricity generation. People of my age remember the 3-day week accompanied by rolling 3-hour power cuts. The underlying problem was that electricity generators had run down their stockpiles of coal and so put themselves (and the country) in a vulnerable position when the miners went on strike.

Heath called a “who runs Britain?”-themed general election. The voters’ reply was “not you” and Harold Wilson (Labour) became Prime Minister in a hung parliament. Wilson subsequently awarded the miners a 35% pay rise.

You may be thinking: nothing like this could happen now?

Well, obviously no-one (except possibly bankers) would get a 35% pay rise and the top 1% of earners would never settle for so little. But there are some similarities…

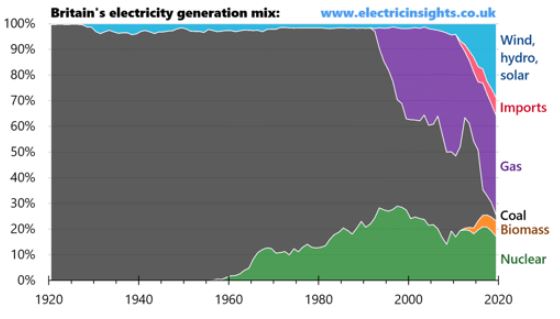

50 years of electricity generation

Reports in the last 24 hours warn that, in a realistic worst case scenario, rolling 3-hour power cuts may be returning to Britain this winter. So what has changed in the past 50 years?

This graph (which covers the last 100 years) shows that, in the 1920s, all our electricity was generated by coal. At the time of the 3-day week, nuclear and a small amount of hydro power had made some incursions, together representing about 10-12% of electricity generated. So the miners still held enormous power over our electricity needs.

The really big changes have occurred in the last 30 years. In the 1990s, gas started to make big inroads into the dependence on coal (the latter by now all imported) and nuclear rose steadily over the 40 years from 1960. The past 10 years has seen a dramatic rise in renewables (wind and solar) and coal has now all but disappeared from the mix. Renewables now account for around 30% of electricity generated, the big rise being mainly in offshore wind. The much cheaper onshore wind saw its rise dramatically halted in 2015 by Tory changes to planning rules and NIMBY local authorities. It’s interesting to note that direct electricity imports (by cable), although still small, only feature in the mix from around 12 years ago. (Biomass remains controversial, with sharply differing opinions as to whether or not it can be considered “green”. I think not.)

Out of power

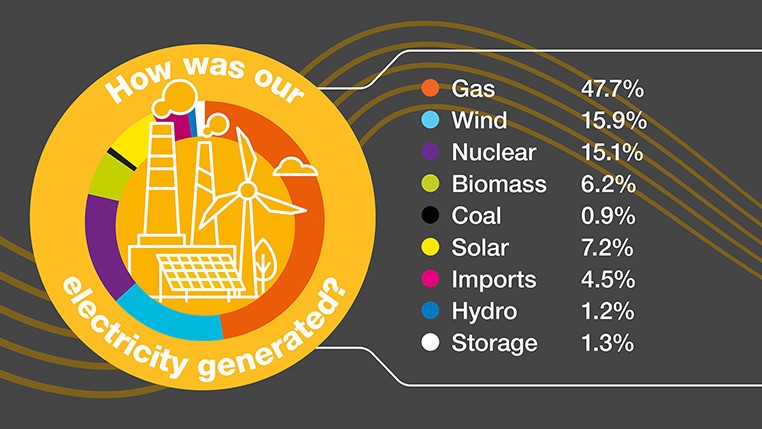

Our current mix of electricity generation looks like this (figures for August 2022):

Gas still dominates: nearly half our electricity comes from gas, which is why it features strongly in the energy price. Coal has all but disappeared, but may make an unwelcome comeback to get us through the winter. “True” renewables (wind, solar, hydro) make up about a quarter, nuclear around 15% – and note that imports account for about 5%.

The government is correct to identify the Russian withdrawal of gas from world markets as the biggest disruptive effect to global gas supply. We import around 60% of our gas consumption (as both a fuel and for electricity generation) and export around 20%.

But there are 3 areas in which the UK has shot itself in the foot:

- As already mentioned, a much faster rollout of onshore wind – the cheapest source of electricity – would have left us far less dependent on fossil fuels, benefiting both imports and CO2 emissions.

- The UK has some of the most badly insulated houses in Europe. Government policies and schemes have gone through some bewildering changes and budget reductions in the past decade or so. A more consistent and generous national scheme over the past few years would have brought a double benefit. Households would have warmer homes and lower energy bills. The country would use less gas.

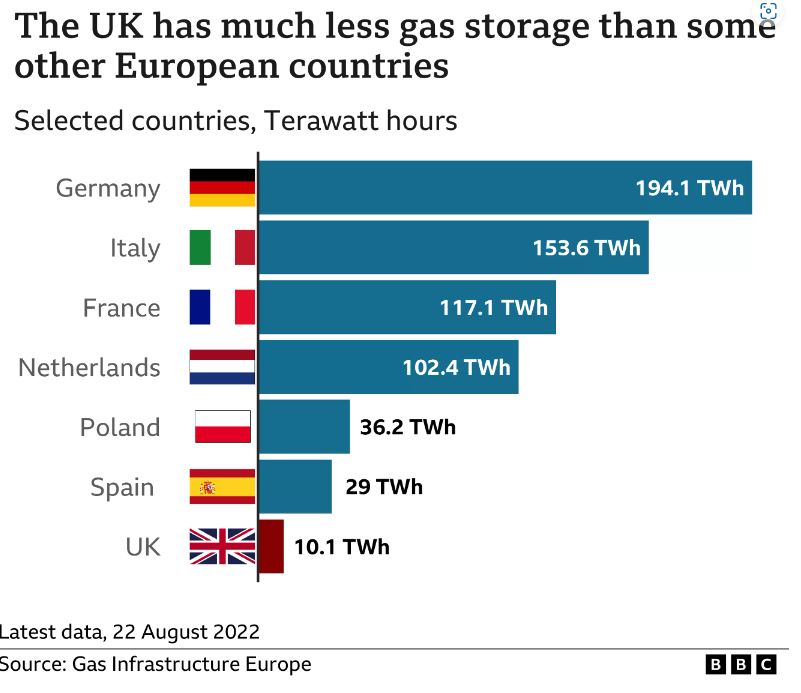

- Last, and not least, the UK made a bad strategic decision in 2017 to allow Centrica to close the country’s biggest gas storage facility. This decision has been recently reversed but the country was warned at the time that the closure exposes the UK to more volatile gas prices and a likely higher dependence on imported hydrocarbons. Sounds familiar?

EU countries with ample gas storage facilities have been filling these over the summer months to provide a buffer stock for the winter. Currently, gas stored across the EU is at 90.4% of capacity, representing just over 3 months’ demand. By contrast, the UK’s tiny storage facility is 99% full, representing just four and a half days’ demand.

Go figure. And they say history does not repeat itself.