Towards the end of Monty Python’s Life of Brian film, there is a scene where a row of condemned prisoners shuffle past a sympathetic Roman officer (played by Michael Palin). He checks each prisoner to ensure they are in the right line and asks each in turn “Crucifixion?” The first few prisoners confirm this and the officer directs them to where they can pick up their crosses. One prisoner tries it on: he says it was all a mistake and that he was promised his freedom. The officer immediately believes him but, on the brink of his release, the prisoner admits he was lying and he’s really due for crucifixion.

Given the choice, would you opt for freedom or crucifixion? The answer, in modern parlance, is a “no brainer”.

Thomas Picketty’s book Capital in the 21st Century is a review of western capitalism over the past 200 years. Some of the more depressing findings in the book are:

- Income inequality was extremely high in Europe just before World War I

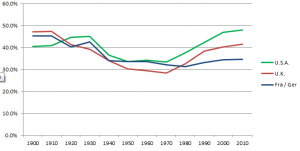

- Inequality in the USA has now risen above this level, with Britain and other main European countries not far behind (see chart below)

- The fall in inequality in the mid-20th century was the result of the two world wars; inequality is now climbing back to its “natural” level.

The graph above shows a measure of inequality of income; inequality of wealth is far higher.

Picketty argues that the fall in inequality after the wars was due to a combination of two exceptional factors:

- The physical destruction of capital and the earnings derived from it, through real estate, bonds, stocks and shares, etc.

- Emergency high levels of progressive taxation and similar policies (war bonds, etc.) made possible by changes in popular attitude: wartime solidarity, need to rebuild infrastructure, etc.

He goes on to show that, under current economic policies, inequality will continue to rise to equal or surpass the pre-1914 levels. He argues that, in the long term, this would be incompatible with modern liberal democracy: sooner or later, it will end in tears – war or revolution or some such. He suggests a less violent alternative:

- increased progressive taxation (especially on wealth)

- closer international cooperation on taxation policy, starting with the countries of the EU

- inter-governmental exchange of data to give transparency of global wealth.

These measures would also enable systematic steps to reduce or eliminate tax havens, currently estimated by Gabriel Zucman of the LSE to harbour about 10% of global GDP.

So, what’s it to be? War or taxation? Freedom or crucifixion? It’s a no brainer.