The news last week that the financial regulator, the Financial Conduct Authority, was dropping its investigation into the culture and conduct of the banking industry came as no surprise. But it was deplorable and depressing news. With over 50% of Conservative Party funding coming from the City of London, any reasonable person will be highly suspicious as to who leant on the FCA to cancel their review. (Of course, the FCA will deny any outside pressure!) I would expect any genuinely independent investigation into the business practices of financial services would conclude that greed, aggressive pursuit of narrow self-interest and other such unethical behaviour is endemic.

The Way That They Do It

My previous post, The City: Paragon or Parasite, considered the benefits, or otherwise, to the UK of a huge financial sector. My conclusions were that an over-powerful City is bad news for us all. But this is not just about what they do, but also the way that they do it.

The Spread of Unethical Practice

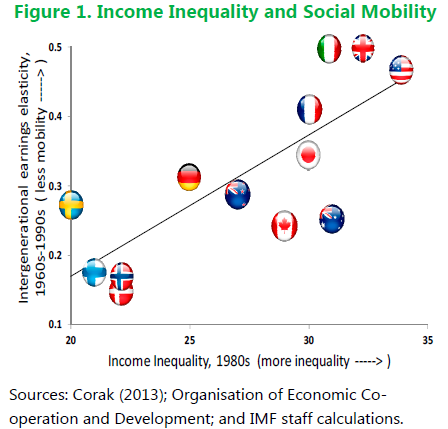

For several months, I had been considering a piece on the general standard of business ethics today. My belief is that the rot started in the City in the 1980s and has spread widely since. I’d welcome a debate on the timing and sequence of events, but my recollection goes something like this.

The banks started it, with unjustifiably high penalty charges and fees, e.g. for going a few pounds (or pence) overdrawn. The spread of interest rates between borrowing and savings rates has gradually widened over the years, enabling banks to cream off more and more of the difference as profits.

Coincidentally, today’s Observer carries a piece by Will Hutton which lists further examples of unethical banking practice. Quoting from economist John Kay, here’s a sample: “Investment banks, according to Kay, have three other main routes to make profits, all deploying the innocent word ‘arbitrage’. In plain English, fiscal arbitrage is playing games avoiding tax; regulatory arbitrage is about doing in one country what is forbidden in others; and accounting arbitrage is about hiding what you are up to.”

After the banks, their cousins the insurance industry continued the decline in ethical standards. They had two main wheezes. Firstly, financially useless products, such as PPI, were aggressively sold via retailers. Secondly, they started pushing up prices to “lazy” existing customers on premium renewal, whilst aggressively price-cutting to gain market share from new customers. The “disloyalty bonus” was born.

Next, the privatized utility companies copied the insurers with the same “disloyalty bonus” tricks – see my earlier post Cat and Mouse. They also invented a spectacularly complex mix of tariffs designed to make price comparisons difficult. They adopted the practice of rapid price rises in the retail price of gas and electricity when wholesale prices rose, together with very slow retail price cuts when the wholesale price fell. The petrol companies quickly took up the “rapid rise, slow fall” strategy to retail pricing. The privatized rail companies adopted the “confusing fares” policy.

Major multinational (usually American) online retailers adopted the tax avoidance game through lack of transparency and phoney transfer pricing between their operations in different countries. The customer service call centres of major brands offer appalling service. I recall a survey which showed customers wait six or seven times longer to get a reply from customer service numbers than from sales departments.

The market for mobile phone service is fiercely competitive. Companies compete mainly on the headline price, with the usual price complexity thrown in to confuse. They have to make their profits somehow. An example is grossly excessive overpricing for some aspects of their service. I was recently caught out by such a practice when I exceeded the limit on my mobile data usage. The effective rate per megabyte was a totally unjustifiable seventy times higher than the package rate.

Whatever Happened to Mutual Respect?

I could go on with further examples, but you get the point. It would be a rose-tinted fantasy to say that all was wonderful in the world of business ethics thirty or forty years ago. But, as companies were smaller, decision making was taken at a more local, and personal, level. Perhaps the pompous Captain Mainwaring-like bank manager was not obviously better than “the computer says no”. But, for the former, normal rules of human behaviour demanded a measure of mutual respect. It’s so much easier to treat your customers badly if the decision is “made” by an online algorithm.

Campaign to Stop the Rot

In those areas where we do have a genuine choice to take our business elsewhere, we have some measure of control. But in the areas of “natural monopoly” like rail travel, gas and electricity, the poor customer feels helpless. In the 1970s, CAMRA (The Campaign for Real Ale) was a great, successful fightback against corporate uniformity and blandness. We need an equivalent “Campaign for Business Ethics” to start the fight back – come on, CAMBErs! Wakey-wakey! You’ve nothing to lose!